How Installment Loans Can Help You Avoid Payday Loan Debt

When you’re hit with a large, sudden bill, it can blow a hole in your finances, leaving you scrambling to find a way to cover your bill and to support yourself until your next paycheck comes in. It’s for this reason that many people consider applying for a payday loan.

While payday loans can be useful in the short-term, they frequently trap you in a vicious cycle of debt, putting you in a worse financial situation than you might imagine. Fortunately, if you want to avoid payday loan debt, you have the option of using an installment loan. Learn how installment loans can help you avoid payday loan debt.

Key Takeaways

|

The Payday Loan Debt Trap

Understanding the Trap – What is a Payday Loan?

The concept of a payday loan is deceptively simple: it’s a short-term loan, typically for a small amount, intended to cover a borrower’s expenses until their next payday. However, this straightforward concept masks a more complex and often hazardous reality. The payday loan debt trap begins innocently enough — a small cash advance to manage immediate financial needs.

But the trap is set once the loan comes due.

The Cycle of Debt

When the next paycheck arrives, borrowers find themselves facing a critical decision. Paying off the payday loan in full often means there’s not enough money left to cover regular expenses, leading to a shortfall before the next payday. This shortfall forces many borrowers to take out another payday loan, creating a cycle of borrowing that becomes increasingly difficult to break.

High Interest Rates and Fees

The primary driver of this debt cycle is the excessive interest rates and fees charged by payday lenders. When a borrower extends or “rolls over” their loan, these fees accumulate rapidly, often resulting in the total amount repaid being many times the original loan amount.

The Real Cost of Payday Loans

Consider a borrower who takes out a $300 payday loan with a two-week term and a 15% fee, amounting to $45. If they cannot repay this loan in the initial term and must extend it, they will owe the original $300 plus the $45 fee, along with an additional fee for the extended term. This cycle can repeat multiple times, leading to a situation where the borrower ends up paying several times more than the original loan amount in fees alone.

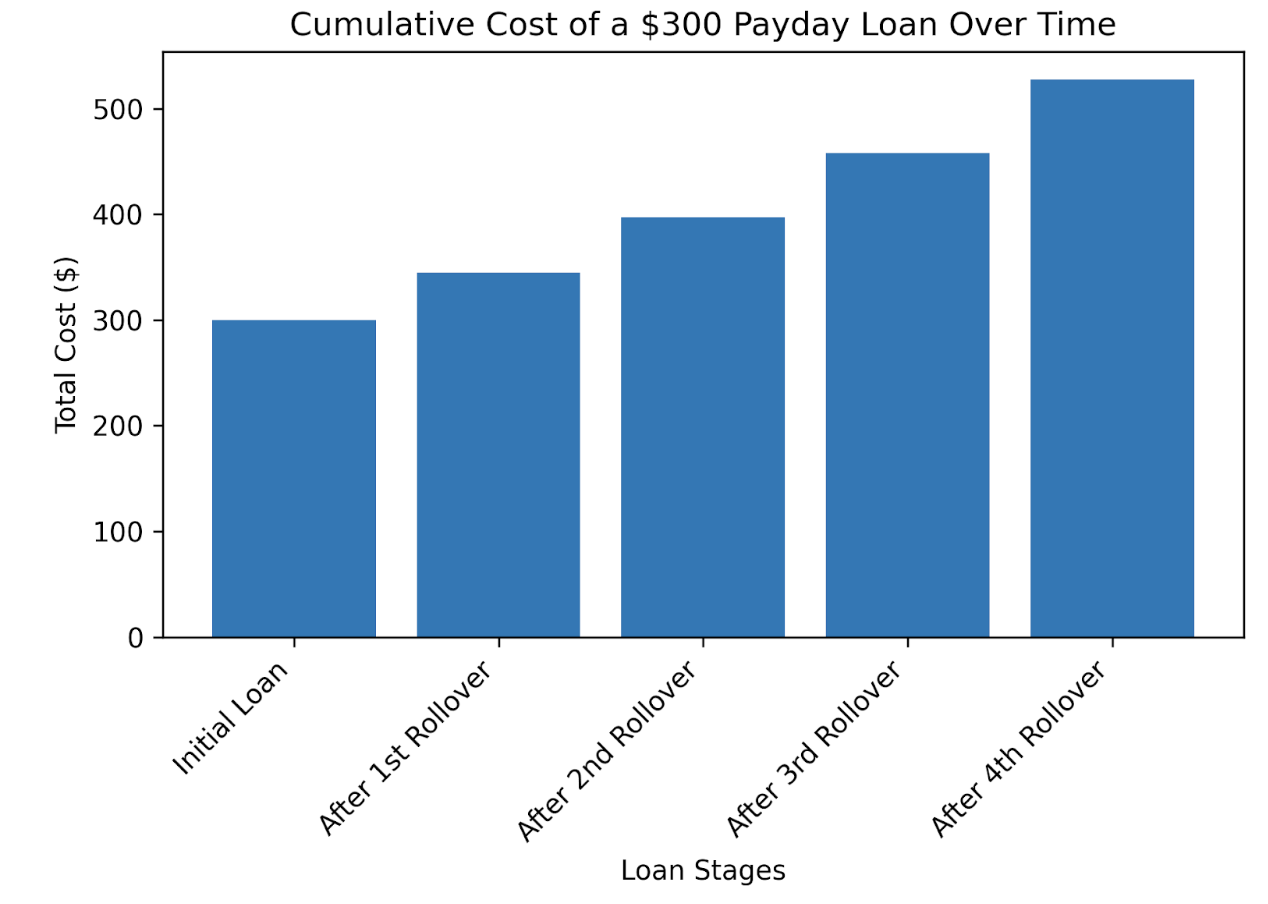

This graph shows how a $300 payday loan can significantly increase in cost due to fees and interest when rolled over:

- Initial Loan: $300

- After 1st Rollover: $345

- After 2nd Rollover: $397.25

- After 3rd Rollover: $457.84

- After 4th Rollover: $527.52

The Psychological and Financial Impact

The stress and anxiety associated with being trapped in a cycle of debt cannot be overstated. Borrowers often feel overwhelmed, helpless, and trapped. This psychological burden can have significant impacts on personal well-being, work performance, and family life. Financially, the consequences are equally dire: damaged credit scores, the inability to handle other financial responsibilities, and even the risk of bankruptcy.

How Installment Loans Help You Avoid Payday Loan Debt

While payday loans might seem like a quick fix, installment loans can be a smarter alternative that helps you sidestep the pitfalls of payday loans. Here’s how installment loans can save you from payday loan debt:

1. Longer Repayment Terms

Payday loans typically require full repayment, along with interest, on your next payday. This short turnaround can be challenging for many borrowers. Installment loans, on the other hand, offer longer repayment terms. You can pay back the loan over a series of months, making it more manageable and reducing the risk of financial strain.

2. Predictable Monthly Payments

With payday loans, you’re often required to repay the entire amount in one lump sum, which can be a shock to your budget. Installment loans provide predictability with fixed payments. You know exactly how much to budget for each month, ensuring that your financial obligations won’t catch you off guard.

3. Lower Interest Rates

Payday loans come with extremely high-interest rates. In contrast, installment loans typically offer more reasonable interest rates, which makes them a more cost-effective option for borrowing. Lower interest rates mean you’ll pay less in the long run and are less likely to fall into a cycle of debt.

4. Responsible Financial Planning

Installment loans encourage responsible financial planning. You can choose a loan term and monthly payment that fits your budget and financial goals. This level of customization allows you to borrow what you need while ensuring that you can comfortably repay it.

5. Escape the Debt Cycle

The biggest benefit of installment loans is the opportunity to break free from the payday loan debt cycle. With payday loans, borrowers often find themselves taking out new loans to cover previous ones, creating a cycle that’s hard to escape. Installment loans provide a clear path toward paying off your debt, without the constant need for new loans.

Embrace Financial Freedom with Installment Loans From Koster’s

Installment loans encourage financial stability, responsible budgeting, and the chance to escape the never-ending debt cycle. Don’t let payday loans hold you hostage any longer. Make the choice that leads to a brighter financial future. Contact Koster’s Cash Loans today and explore how our installment loans can help you break free from payday loan debt.