Quick Ways to Borrow Money in an Emergency Situation

Facing an unexpected financial pinch? Discover effective ways to secure emergency funds quickly. From navigating personal loans to understanding the pros and cons of borrowing from friends and family, we provide clear options to help you manage those urgent financial needs. Plus, we offer insights into long-term strategies to better prepare for future surprises. Get the answers you need now to tackle any financial emergency head-on.

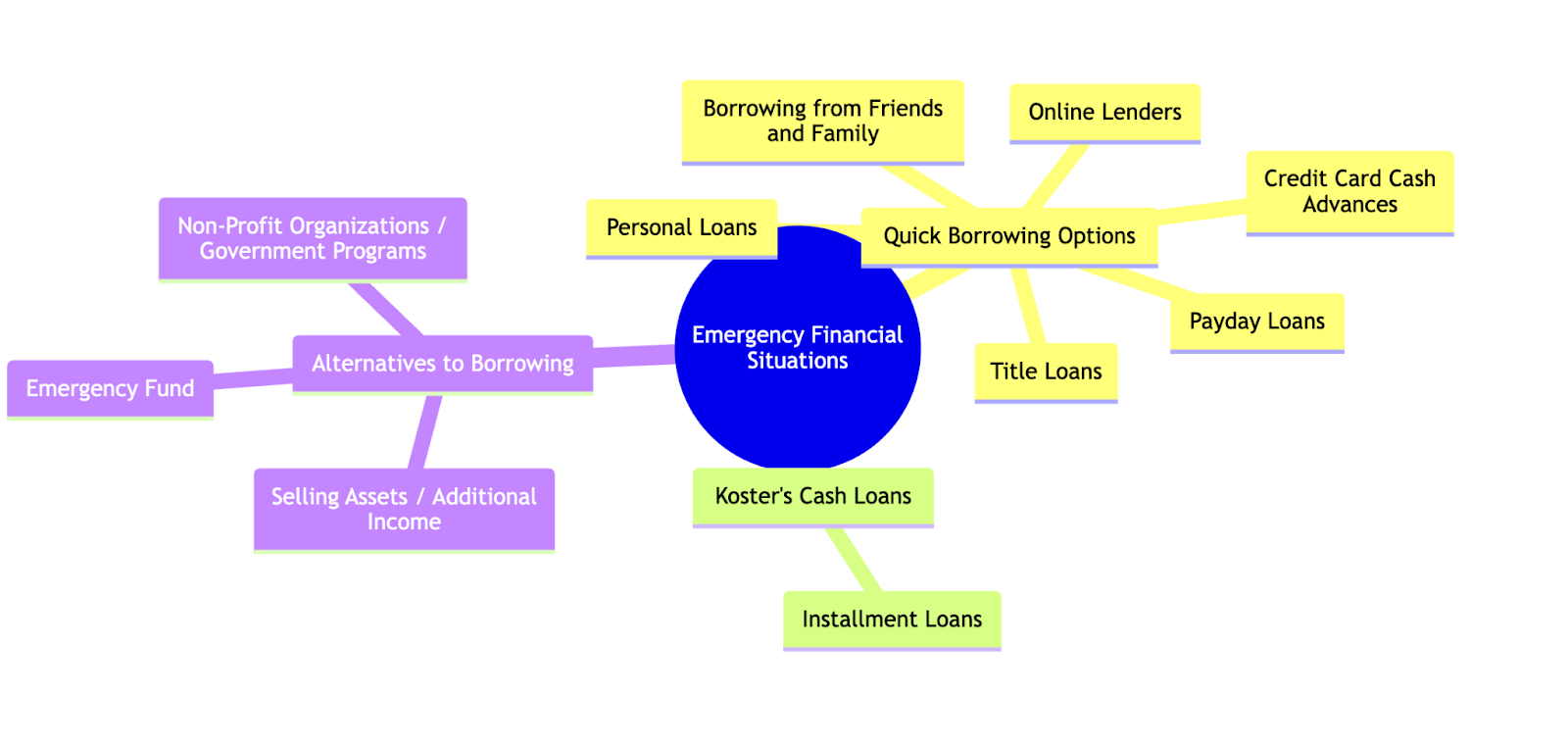

Diagram Overview: Get a quick visual rundown of our article, “Quick Ways to Borrow Money in an Emergency Situation.” This mind map breaks down your options for immediate funding, from personal loans to family support. It’s your quick guide to understanding emergency financial solutions.

6 Quick Borrowing Options

Quick borrowing options are ways to get money fast when you’re in an emergency. Each way to borrow money is different, with its own rules, costs, and things you need to know, depending on what you need the money for.

1.Personal Loans

Personal loans are money you can borrow from places like banks, credit unions, or online. You can use this money for different needs like buying things or paying off debts. These loans are good because they usually have lower interest rates than credit cards, and you know how much you need to pay back each time. But, getting approved for these loans might depend on your credit score, and it can take a while to get the loan. They are best for when you have expenses that you know are coming up, like big purchases or paying off other debts, and you’re okay with waiting a bit for the money.

2. Credit Card Cash Advances

A credit card cash advance is when you get a short-term loan from your credit card company. You can get this money from an ATM or a bank. It lets you take out some cash, but only up to a certain amount. This kind of loan usually costs more because it has higher interest rates than what you pay when you buy things with your card. Also, you start getting charged interest right away, and there might be extra fees. It’s a handy option if you really need cash fast, but you should be careful because it can be expensive.

3. Payday Loans

A payday loan is a small, short-term loan that you can get without any security, usually by showing a check that you’ll cash later or a paystub. These loans can be risky because they have really high interest rates and fees. If you keep taking new loans to pay off the old ones, it can lead to a lot of debt. You should think about using a payday loan only if you really have to and if you’re sure you can pay it back with your next paycheck.

4. Title Loans

Title loans are short-term loans where you use your car’s title as a promise to pay back the loan. These loans can be risky because they have high interest rates, and if you can’t pay the loan back, you might lose your car. You should think about getting a title loan only if you don’t have other choices and you’re really sure that you can pay the loan back.

5. Online Lenders

Online lenders are companies or websites that let you borrow money over the internet. They offer different kinds of loans. One good thing about them is they usually work faster than regular banks when it comes to applying and getting approved for a loan. They might not be as strict about your credit score as banks are. A lot of these online lenders can process your loan really fast, and sometimes you can even get the money the same day you apply. These loans are great for people who need money quickly and are okay with doing everything online.

6. Borrowing from Friends and Family

Borrowing from friends and family means getting a personal loan from people you know, like your relatives or buddies. The good part is these loans usually don’t have interest, and you can often agree on how to pay them back in a way that works for you. But the downside is, if you don’t pay back the loan as you agreed, or if things aren’t clear from the start, it can make things awkward or hurt your relationship with them. To avoid problems, it’s a good idea to talk clearly about the loan and maybe even write down the agreement to make sure everyone understands and agrees.

7. Installment Loans from Koster’s Cash Loans

An installment loan is a type of loan where the borrower repays the loan amount in regular, scheduled payments over a set period of time. This contrasts with payday loans or title loans, where the entire amount is often due in a single lump sum.

Features and Benefits:

- Fixed Payment Schedule: Unlike flexible credit lines, installment loans have a predetermined repayment schedule, making budgeting easier and more predictable.

- Longer Repayment Terms: Compared to payday or title loans, installment loans typically allow for a longer repayment period. This reduces the financial burden on each payday and makes the loan more manageable over time.

- Potentially Lower Interest Rates: Installment loans often come with lower interest rates than payday or title loans, reducing the overall cost of borrowing.

- No Collateral Required: Unlike title loans, installment loans from Koster’s do not require any form of collateral, such as a vehicle. This feature is crucial for borrowers who need access to funds but do not have or do not wish to risk their assets.

- Quick and Easy Application Process: Koster’s Cash Loans prides itself on a streamlined application process, allowing for quick approval and disbursement of funds, which is vital in emergency situations.

3 Alternatives to Borrowing

While borrowing can provide immediate financial relief in emergencies, it’s also important to consider alternatives that can prevent or reduce the need for taking on debt. Here are some key strategies:

1. Maintaining an Emergency Fund

An emergency fund is a savings account specifically set aside for unplanned expenses or financial emergencies.To build it, you can start by saving a little bit of your money regularly. Even if it’s not a lot, having some money saved up for emergencies can really help when you need it.

2. Selling Assets or Generating Additional Income

In times of financial crunch, consider getting rid of assets that you don’t immediately need. This could be anything from selling unused electronics to a second car.

Generating additional income through part-time jobs, freelance work, or a side hustle can also provide extra funds. This not only helps in the short term, but can also contribute to your emergency savings.

3. Seeking Assistance from Non-Profit Organizations or Government Programs

Various non-profit organizations offer financial assistance or low-interest loans, especially during crises such as natural disasters, medical emergencies, or economic downturns.

Government programs have different ways to help, such as unemployment benefits, food assistance, or emergency grants. Check eligibility for such programs, as they can offer significant help without the need to repay.

Navigating Financial Emergencies with Koster’s Cash Loans

In times of financial emergencies, knowing your options is crucial. From personal loans to support from loved ones, the right choice can make all the difference. And for those seeking a reliable and structured borrowing option, Koster’s Cash Loans offers installment loans tailored to your needs. With manageable repayment terms and customer-focused service, we’re here to help you navigate through these challenging times.

Don’t let financial surprises throw you off course. Visit Koster’s Cash Loans today to explore how our installment loans can be part of your solution for immediate financial relief and long-term stability.